PFE calculations in 15 minutes… really.

Potential Future Exposure (PFE) is essential to bank regulation under Basel III and Dodd Frank. It is a tool necessary for evaluating whether an organisation is resilient under stressing market moves.

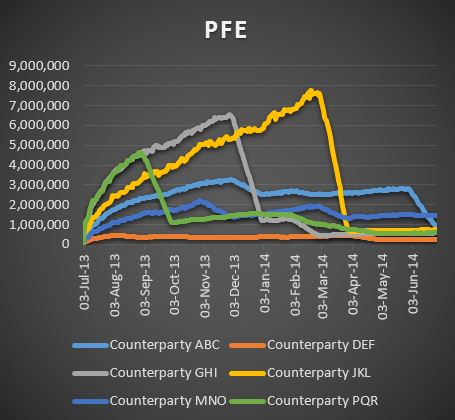

Our PFE system calculates the nth percentile daily worst case counterparty credit exposure over a time horizon in days due to market price moves. And it does it fast.

We’ve worked with many PFE systems over the years and the fastest ones normally take an hour or longer to run. Using the Skew Vega PFE system, a PFE calculation of a portfolio containing tens of thousands of trades across a time horizon of 5 years (1,250 working days) will take 15 minutes or less to run. Now that’s fast.

Using our PFE system, any time horizon can be specified and several years is standard. Netting agreements affecting the positions and trades are applied to the calculation. A netting agreement is a legally binding contract which indicates whether the debt of a given company to a counterparty can be offset by debts of the counterparty to the company.

PFE is computationally intensive and as such we can implement a cloud based pay-as-you go model for clients that have limited computing resources.